(Finance Used Car Toronto | Finance Used Car Ontario | Low Finance Car Rate)

If you’re planning to buy or finance a used car in Toronto or anywhere in Ontario, understanding how car loans work in Canada can help you save thousands of dollars. Whether you’re shopping for a reliable SUV, a family sedan, or a used Tesla, this complete 2025 car loan guide from YST Auto Sales will help you make smart financing decisions — even if your credit isn’t perfect.

The Basics of Car Loans in Canada

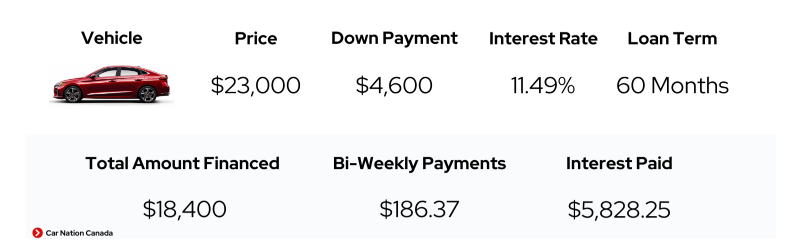

1. Principal Amount

The principal amount is the total you borrow to purchase your vehicle.

Example: if your car costs $25,000 and you make a $5,000 down payment, your loan principal is $20,000.

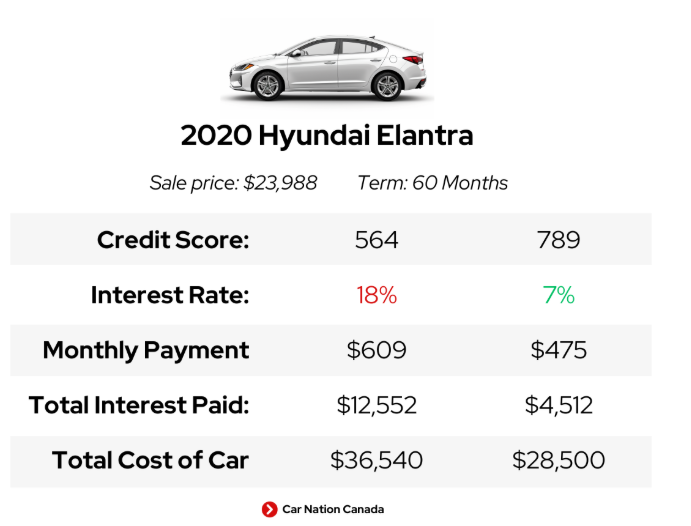

2. Interest Rate

This is what the lender charges you for borrowing money. Your rate depends on your credit score, income, and loan term.

A low finance car rate can save you thousands over the life of your loan — that’s why it pays to compare offers from multiple lenders in Toronto or Ontario.

3. Loan Term

Loan terms usually range from 36 to 84 months (3 to 7 years).

A longer term means smaller monthly payments, but you’ll pay more interest overall.

4. Down Payment

The amount you pay upfront.

A higher down payment means borrowing less, which results in lower monthly payments and less interest. Some lenders even offer zero-down car financing — great if you need to finance a used car in Ontario quickly.

5. Monthly Payments

This is what you pay each month to repay your loan, including principal and interest.

Common Car Loan Myths

Myth 1: You need perfect credit to get a car loan.

Reality: Not true! Many lenders and dealerships, including YST Auto Sales, work with clients who have low credit or no credit history and still offer competitive used car finance rates.

Myth 2: Always choose the shortest loan term.

Reality: Shorter terms save interest but raise your monthly payment. Choose a loan term that fits your budget comfortably.

How to Finance a Used Car in Toronto or Ontario

There are two main paths to car financing:

1. Get Pre-Approved First

Pre-approval means you apply for financing before shopping.

You’ll know exactly how much you can spend and what interest rate to expect — a great strategy if you want to finance a used car in Toronto with confidence.

2. Find Your Car, Then Apply

If you’ve already chosen your car (maybe a used Tesla or Mercedes, BMW), you can apply for financing directly through YST Auto Sales or your bank/credit union.

Steps to Secure a Car Loan

(1)Apply Online or In-Store – Submit your income, employment, and credit info. YST Auto offers a quick and secure online car loan application.

(2)Get Approved – Lenders assess your credit, income, and stability.

(3)Sign & Drive – Once approved, finalize your down payment, sign the agreement, and drive away in your new or used car.

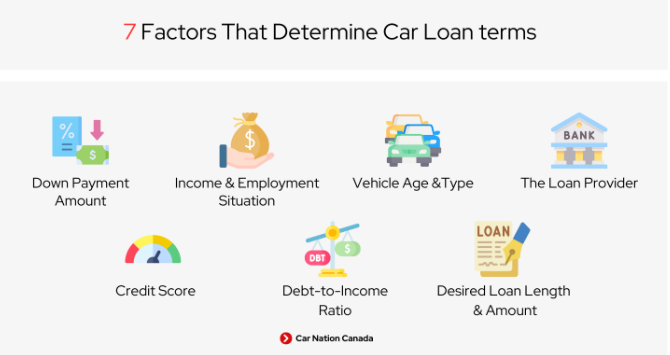

What Affects Your Car Loan Terms?

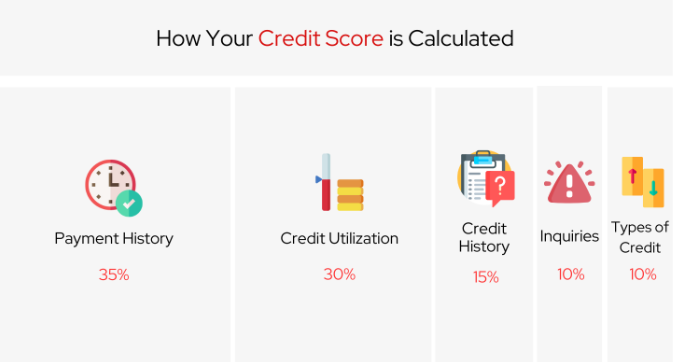

- Credit Score: Higher credit = lower interest.

- Vehicle Age: Newer cars often qualify for lower finance rates, but used cars offer better value.

- Down Payment Size: A larger payment can unlock lower interest rates.

- Income Stability: Proof of steady income helps your approval chances.

- Loan Term: Shorter = higher monthly cost but less total interest.

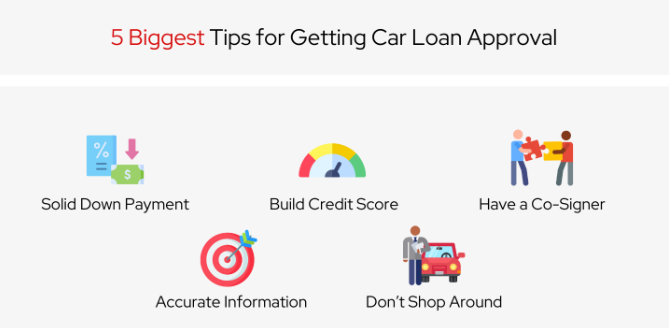

Tips to Get the Lowest Finance Car Rate in Ontario

- Improve Your Credit – Pay bills on time and reduce credit card balances.

- Add a Co-Signer – Someone with strong credit can help lower your rate.

- Increase Your Down Payment – Even $1,000 more upfront can reduce your total interest.

- Shop Around – Compare car finance offers in Toronto and Ontario; YST Auto can help you access multiple lenders.

- Negotiate – Ask about rate discounts or dealer promotions.

Car Loan FAQs

Q1: What credit score do I need for a car loan in Canada?

A score above 650 is considered good, but YST Auto also helps clients with lower scores through flexible finance programs.

Q2: Can I get a car loan with bad credit?

Yes! We specialize in car finance for bad credit in Toronto and Ontario. Our lenders offer affordable solutions even if your credit history isn’t perfect.

Q3: Can I finance a used Gas Car or EV?

Absolutely. YST Auto offers used Gas Car financing and other EV car loans with competitive rates and extended terms.

Q4: How long does approval take?

Online pre-approval can be completed in minutes, and most customers drive away within a few days.

Q5: Can I use my trade-in as a down payment?

Yes — your trade-in value can be applied directly toward your new or used car loan in Ontario.

Finance a Used Car in Toronto or Ontario with YST Auto Sales

At YST Auto Sales, we provide transparent listings and professional used car valuation services to help you buy and sell with confidence.

Ready to Find Your Next Car?

Browse Our Used Cars for Sale

Book a Free Consultation

Get an Instant Used Car Valuation

Let YST Auto Sales make your car buying or selling journey easy, transparent, and stress-free.

Contact us any time, you can call 905-276-4071, or come to our office at 8243 Yonge St, Thornhill, ON, L3T 2C7.

article source: carnationcanada